Advertisers Embrace Programmatic Advertising As Cookies Decline

The use of unreliable and mostly independent third-party cookies is coming to an end. What the industry does next is currently up for discussion. While some solutions will look at the context of a webpage, others will concentrate on interest, and some will try to develop a widely used but privacy-first ID system. Over the coming year, the majority of advertisers and agencies want to increase their programmatic spending while third-party cookies continue to be phased out. About 58% of advertisers are unprepared to operate in the cookie-less world, according to Warc’s research. The cause is cited as a lack of practical knowledge of how their work is still impacted by evolving privacy laws. Additionally, the report noted that more than 60% of marketers have reservations about reaching audiences without the use of third-party cookies.

Cookies Phase Out Story Until Now

Google stated that it would stop enabling third-party cookies in the Chrome browser in 2021. Other browsers rapidly followed suit after this. The advertising industry was rocked by this news, leaving marketers unsure of what to do next. However, companies are recognizing the chances to monetize the advertising industry through their ecosystems, despite any potential downsides. Advertisers realize the advantages of properly framing their advertising and connecting with people by meeting their requirements. Additionally, they can guarantee user data security and foster transparency. By enabling end users to place more trust in companies, the improved security has enabled advertisers to forge closer connections with consumers.

Around 95% of the web is expected to anonymize with the phase-out of third-party cookies. It has greatly increased prospects for new ecosystems to arise by leaving a vast hole on the internet. However, due to several unanticipated circumstances, the phase-out was extended until 2023. The UK and the EEA’s revised privacy laws, Google’s testing of the Federal Learning of Cohorts (FLoC) and Privacy Sandbox, and a high level of user demand for enhanced transparency are the causes.

Google is now planning to roll out this modification gradually, starting with 1% of Chrome users in early 2024. Developers will be able to evaluate their preparation for the wider shift during the initial phase, which will act as a practical test. A considerable change in advertising tactics is necessary as a result of the deprecation of third-party cookies. Adversaries need to investigate alternatives to specific user tracking for targeting and measurement. It is advised to negotiate the change by utilizing first-party data, investing in contextual targeting, and working with business partners.

Read More: End Of Third-Party Cookies, What Is There For Marketers: Takeaway!

The Current State of the Programmatic Landscape

Over the previous few years, programmatic ad spending has doubled due to exponential growth. Programmatic advertising has become a major role in the dynamic world of ad technology. Since its introduction, it has been significantly advancing the advertising sector. The buying and selling of ad inventory has been streamlined and made more effective than ever thanks to its automation features. In 2023, as we reach the halfway point, a few things have changed. Advertisers should keep a close eye on a number of programmatic advertising trends to maintain an edge over rivals.

Examining Possible Replacements for Third-Party Cookies

Cookies are being resisted due to privacy issues. Publishing companies must therefore prioritize identifying options for the third party. However, research from Adobe claims that 74% of users still rely on third-party cookies, and this is worrying. However, according to a different survey, 41% of marketers still think that removing third-party cookies will be one of the most difficult tasks. Therefore, in order to prevent any interruptions to their advertising campaigns, marketers will need to find alternatives to third-party cookies.

Growth of DOOH

In the years following the pandemic, offline buying has increased. More and more individuals are going to physical stores to make purchases. The recent boom in programmatic advertising is unrestricted by cookie regulations. As a result, marketers ought to concentrate on billboard advertisements. People’s interactions with offline advertising are vastly improving. This includes interactive display ads, 3D billboards, and more. The amount spent on digital out-of-home (DOOH) advertising in the United States will increase by around 11.4 percent to almost 2.94 billion dollars by 2023, predicts Statista. This represents more than one-third of the yearly expected OOH ad spending in the US. For the first time ever, in 2023, DOOH ad expenditure will surpass the pre-pandemic spending recorded in 2019. Additional digital screens are appearing for advertisement across the nation. Programmatic strategy is well-positioned to secure a significant chunk of this spending in the upcoming years.

Building programmatic efficiency with AI and ML

The application of AI and ML is a further development in the field of programmatic advertising. Both advertisers and publishers can greatly profit from these technologies. With the help of AI, publishers can better understand their audience, increase user involvement through tailored recommendations, and automate the generation and optimization of content. This leads to scalable presentation and better comprehension. On the other side, AI and ML can quickly analyze vast amounts of data for advertisers. Campaign targeting and automation are now more successful than ever.

The growth of video advertisements.

The popularity of video commercials is predicted to skyrocket. According to Statista, expenditure on video advertising is anticipated to reach 176.6 billion dollars by the end of 2023, growing at a CAGR of 6.80%. The average ad expenditure per internet user in the market for video advertising is anticipated to be 33.13 in 2023. Additionally, connected TV spending is estimated to amount to $30 billion. Furthermore, with better-quality inventory and more straightforward measurement, programmatic video is becoming a more premium medium. Programmatic video is leading the way toward a more creative, targeted, and interactive advertising environment. In general, video advertising is growing rapidly in programmatic advertising.

Read More: And Google Does It Again, Delays Phaseout of Third-Party Cookies

Programmatic advertising without third-party cookies

Programmatic advertising has historically used third-party cookies to target particular audiences. However, the ability of marketers to follow and target audiences on the web is declining due to the gradual decline of the third-party cookie and the adoption of new privacy rules. Programmatic ecosystem scaling has also resulted in the expansion of innovative channels, including connected TV, gaming, programmatic audio, retail, and digital out-of-house.

There is a rush to define what a cookie-less future might entail with third-party cookies on their way out. Programmatic advertising will change, but its status as a crucial tool for digital marketing will endure. In 2023, Statista expects that programmatic ad spending will surpass $550 billion globally. And as technology develops year after year, programmatic advertising remains an interesting field thanks to improved software and algorithms.

According to a report, Dentsu predicts 28% and 15.2% growth rates for retail media and CTV in 2023, respectively, in emerging digital sectors. Additionally, programmatic advertising will account for 71.4% of all digital spending, an increase of 14.4%. According to a different survey by IAB Europe, 74% of advertisers, 80% of agencies, and 68% of publishers anticipate that investments in programmatic trading would rise over the ensuing 12 months. In addition, CTV has become the main growth sector, with more than 50% of stakeholders linking it to the acceleration of programming growth over the coming year.

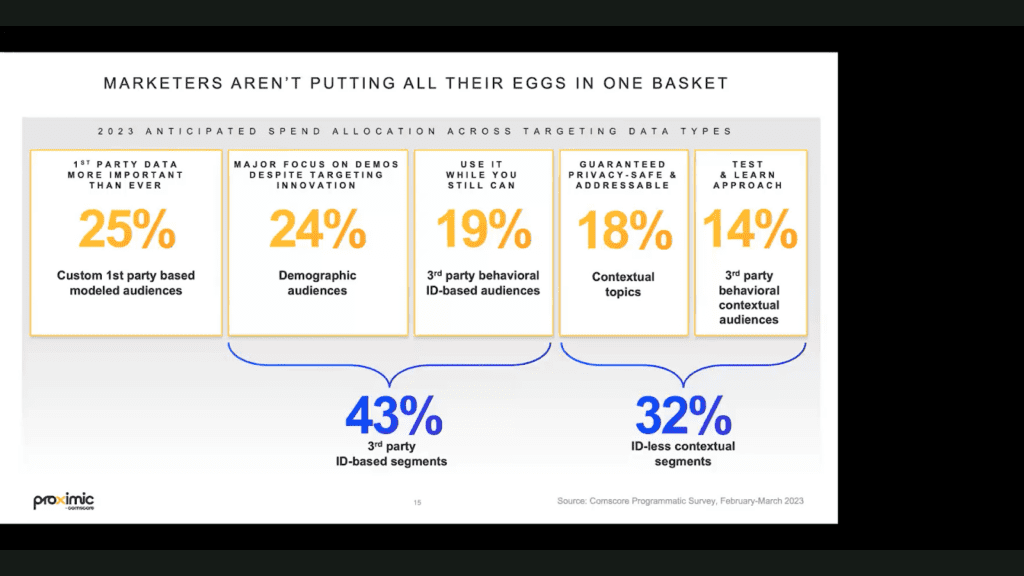

Controlled first-party cookies are prominent in programmatic advertising trends since Google still permits first-party data. It is fantastic for locating the correct audiences on the appropriate platform at the appropriate moment and for contextual advertising. From 2023 to 2035, contextual marketing is expected to grow by 18%. However, to maximize results and ROI, marketers are playing a smart game with the distribution of their ad spend budget.

Image credit- AdMonsters

Read More: Relief To Advertisers As Google Postpones The Elimination Of Third-Party Cookies Till 2023.

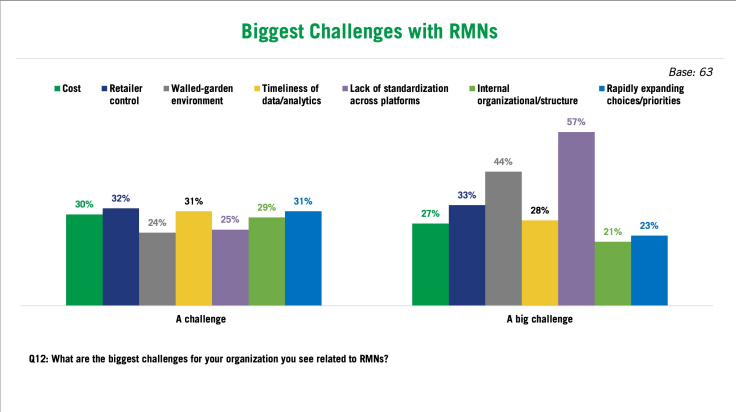

Challenges facing post-third-party cookies arena

However, advertisers still experience difficulties. Lack of consistency is the biggest challenge brands face in managing media networks. They claimed there was annoyance with the quantity, caliber, and uniformity of data and reporting offered by each channel. This increased the brand teams’ efforts and made cross-platform comparisons challenging. The “walled-garden environment” that companies encounter when operating within the ecosystem presented advertisers with their second issue. They remain in the dark regarding their activations, which makes it difficult to maximize their deployment and return on investment. 44% of advertisers reported this problem.

Image credit- ANA

Advertisers continue looking for alternatives to third-party tracking cookies, as cookies completely phase out starting in 2024. They are also investigating more contextual and interest-based targeting models. They include those based on images, audio, location, content sentiment, time, and weather. Additionally, they are working more closely with publishers, platforms, and tech suppliers to take advantage of shared data and insights as they push further to gather first- and second-party data to learn more about their customers. They have, however, also made several cautions about the expansion of programmatic channels.

The demise of third-party cookies marks a critical turning point for the industry. Advertisers are reacting to the novel situation. They now need to adopt cutting-edge tactics and technology to respect consumer tastes and confidentiality while retaining useful functionality. This will turn out to be the real test for them to tap into their creative side!

Read More: Google’s Phasing Out of Third-Party Cookies: A Paradigm Shift in Digital Advertising

Author Profile

- Netra

- Netra is a Dual Masters graduate in International Business and Marketing. She is a content-writing enthusiast and a social media addict. In her downtime, you will find her headbanging to Pop songs from around the world. She is also a sports fanatic and especially loves F1, Volleyball, and Cricket. Her hobbies are baking and watching Anime.

Latest Posts

MediaJuly 26, 2024Rediffusion Unveiles Konjo, a Specialist Agency for New Age Startups

MediaJuly 26, 2024Rediffusion Unveiles Konjo, a Specialist Agency for New Age Startups MediaJuly 26, 2024Farah Golant Joins Seedtag Board of Directors

MediaJuly 26, 2024Farah Golant Joins Seedtag Board of Directors MediaJuly 26, 2024PRCA MENA Announces Imad Lahad as Vice Chair of the Board

MediaJuly 26, 2024PRCA MENA Announces Imad Lahad as Vice Chair of the Board MarketingJuly 26, 2024Google Shelves its Plans to Remove Third-Party Cookies | Experts Speak

MarketingJuly 26, 2024Google Shelves its Plans to Remove Third-Party Cookies | Experts Speak