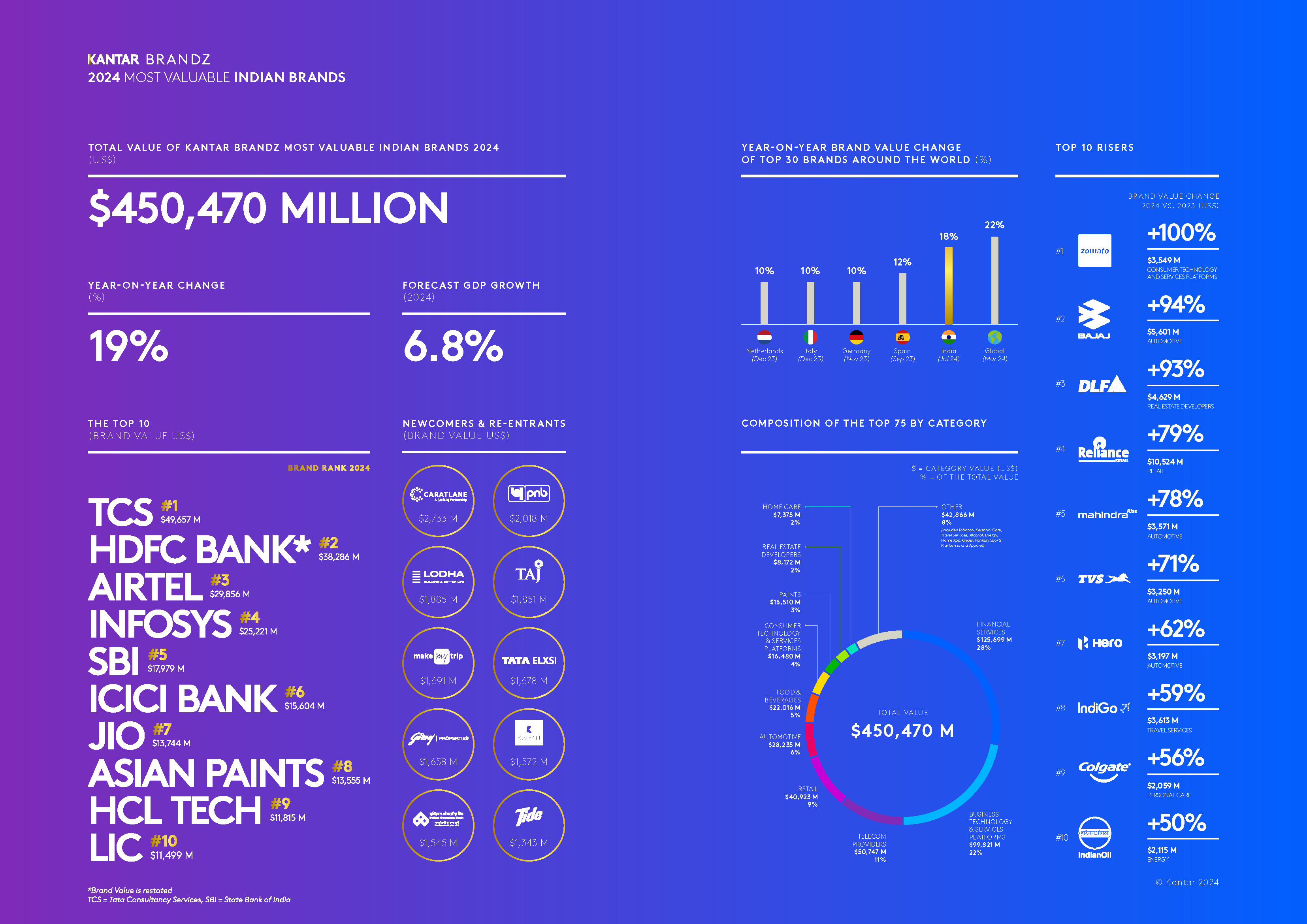

In the latest Kantar BrandZ Top 75 Most Valuable Indian Brands report, the top 75 brands in India now have a combined brand value of $450.5 billion, a remarkable 19% increase from the previous year. This growth was driven by brands from a variety of business sectors; during the previous year, 54 brands increased the value of their brands. TCS is ranked first out of seven platforms that offer business technology and services. These platforms are valued at nearly $100 billion in total, which makes up 22% of the value of India’s Top 75 ranking.

Among the top 75 Indian brands, Zomato is the fastest rising, ranking 31st with a brand value of $3.5 billion. This remarkable accomplishment shows a 100% year-over-year growth, mostly due to its rapid commerce expansion. The Global Top 100 now includes four Indian brands: TCS, HDFC Bank, Airtel, and Infosys. With their inclusion in the list of the top 100 global brands, Flipkart and Britannia served as global representatives of Indian consumer brands. Britannia was ranked 17th in the world, and Flipkart came in at number 20.

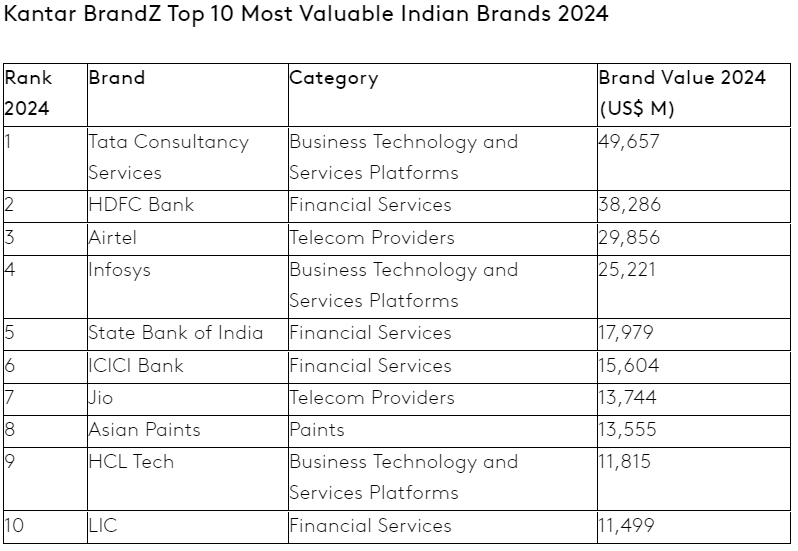

Tata Consultancy Services (TCS) remains India’s most valuable brand for the third consecutive year, according to the new Kantar BrandZ Most Valuable Indian Brands Report. TCS’s brand value, which is $49.7 billion, has increased by 16% from the previous year thanks to investments in innovation, especially in artificial intelligence (AI) and digital transformation.

Brands in the financial services industry also lead the way, accounting for 17 brands and 28% of the total brand value in the ranking. After all, HFDC Bank (ranked No. 2 with $38.3 billion) is still the second most valuable brand in India. The Top 10 also includes State Bank of India (No. 5; $18.0 billion), ICICI Bank (No. 6; $15.6 billion), and LIC (No. 10; $11.5 billion).

Zomato (No. 31; $3.5 billion) is the Fastest Riser of the year, with a 100% yearly growth in brand value attributed to its unwavering innovation and foray into quick commerce. Over the past year, it has also improved customer satisfaction and efficiency.

Notable brands among the new entries in the Kantar BrandZ Top 75 Most Valuable Indian Brands report are real estate brand Lodha (No.63; $1.9bn) and jewelry retailers CaratLane (No.45; $2.7bn) and Kalyan Jewellers (No.71; $1.6bn). Godrej Properties, whose brand is valued at $1.66 billion, also made a comeback, coming in at number 70.

Impressive results have also been seen in the automotive sector, with Maruti Suzuki (No. 17; +24%), Bajaj Auto (No. 20; +94%), Mahindra (No. 30; +78%), TVS (No. 34; +71%), and Hero (No. 35; +62%) leading the way. As of June 2024, 53% of India’s passenger car market is made up of Mahindra SUVs. Mahindra has cemented its leadership in the mid- and premium SUV market with the success of models like the XUV700, Scorpio N, and Thar, which continue to see high demand and lengthy waiting periods.

The demand for cars is being driven by rising disposable income and an expanding middle class, which is turning car ownership from a status symbol to a need. The industry’s momentum is being further fueled by improved infrastructure, government support for electric vehicles, and high growth expectations for exports.

The market for motorized two-wheel vehicles in India is expanding again, propelled by the country’s improving economy and growing need for personal transportation. Urbanization, the demand for reasonably priced transportation, and the burgeoning youth population are important factors. Growth is also being fueled by new models with cutting-edge technology that cater to a variety of consumer needs.

Global expansion and future challenges for Indian brands

The research highlights a lack of global expansion despite India’s robust domestic market, with only 26% of the top brands’ value coming from overseas markets. Kantar highlights the potential that Indian brands have yet to realize on the international scene, which could spur additional expansion.

The report projects that India’s GDP will grow by 8.2%, outpacing the 3.1% global average, and points to a promising future for the nation’s economy. To prevent a long-term drop in demand, Kantar cautions, brands must stay relevant and adjust to changing consumer expectations.

• Possibility of international expansion: Because of the steady local economy, many Indian brands are still largely dependent on the home market. With only 26% of the Top 75 Indian brands coming from outside, the 6.7 billion-person global market is still largely unexplored. To reach their full potential on the international scene, Indian brands need to grow outside of their own country.

• A Blueprint for Brand Growth: Realizing that being Meaningfully Different to more people is a key driver for growth, Kantar’s new Blueprint for Brand Growth is intended to assist companies in creating profitable, robust, and long-lasting brands. The challenge of sustaining meaningful difference is widespread, but it is particularly acute in India. With more than 20% of Indian brands falling behind in this regard, it is more important than ever to differentiate and adapt in order to stay competitive and experience long-term growth.

Read More: Havas Play Brings The Fastest Growing Sport To India With TATA.ev Pickleball Weekend Fiesta