18 February 2026 – Netflix, an established leader in original content production and streaming, has entered a new ad-funded era. Subscription fees still provide the bulk of its revenue with ad revenue accounting for just 3% of its total full-year earnings. But Netflix’s ad tier has evolved from experimental offerings to a primary engine for platform growth. According to WARC forecasts, the company is on track to win nearly 10% of global connected TV (CTV) ad spend in 2027.

This latest Platform Insights report by WARC Media explores Netflix’s ad business, advertiser sentiment, and potential next steps – from prospective acquisitions to new ventures in podcasts,gaming and live events.

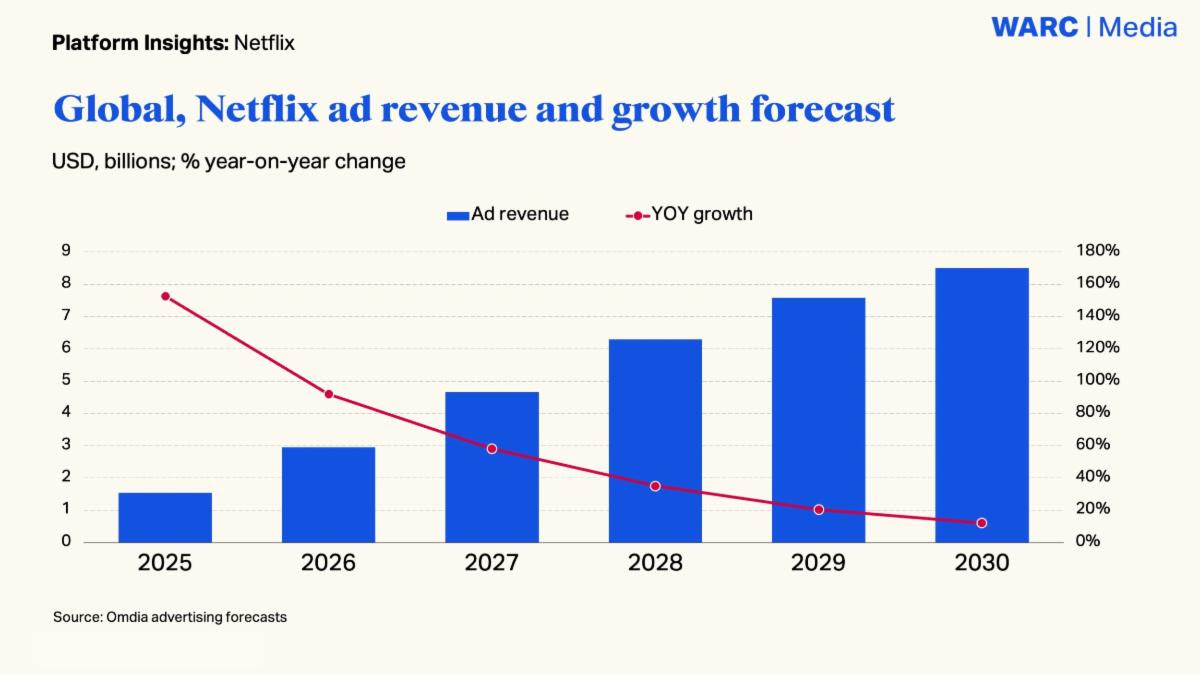

Celeste Huang, Media Insights Analyst, WARC Media, and author of the report, said: “With ad revenue set to double to $3bn by 2026, and with an eye on a growing slice of the streaming ad pie, Netflix is expanding beyond video into a global entertainment hub. It increasingly attracts ad dollars and share of market boosted by live sports, cultural events, Gen Z’s love for brand integrations, and is perceived to be trustworthy by both brands and viewers alike.”

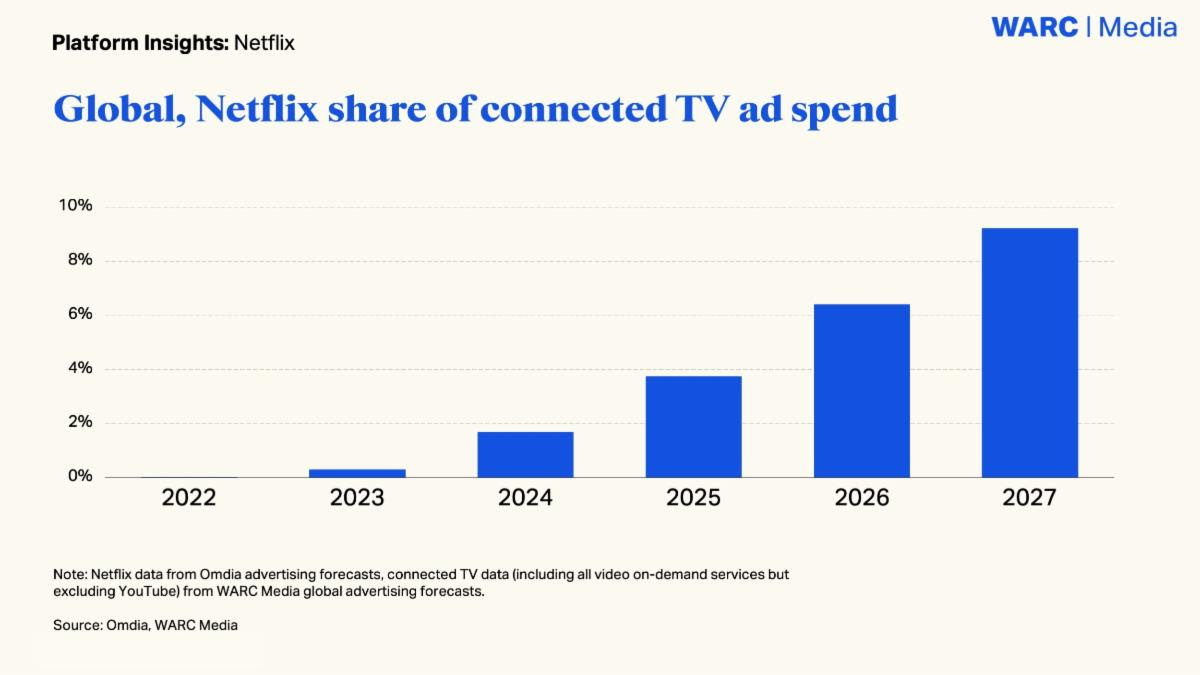

Investment: Netflix’s is on track to win almost 10% of global CTV ad spend in 2027

Netflix has ambitious plans for its ad business. Advertising revenue exceeded $1.5bn in 2025 (3.3% of its total revenue) and aims to double that sum again this year to $3bn, jumping to $8bn by 2030, according to data from Omdia.

The company is targeting competitor share rather than relying on market expansion and is on track to win a rapidly rising portion of connected TV (CTV) spend – from 3.7% in 2025 to 9.2% in 2027, according to WARC Media global CTV advertising spend data.

A potential acquisition of Warner Bros. Discovery would expand its content and bundle offerings, helping it to better monetise its users’ high-attention viewing.

The streamer is entering the video podcast space, which it views as an evolution of the “modern talk show”, and increasing investment in cloud gaming across both mobile and TV, hoping to extend IP impact, deepen retention and fill engagement gaps.

In the US, according to Sensor Tower data for Q2 2025, the top categories for ad spend on Netflix are shopping ($82m), consumer-packaged-goods ($78m), financial services ($66m), travel and tourism ($54m), and telecoms ($44m).

Consumption: Netflix global audience nears 1bn, with members consuming 200 billion hours annually

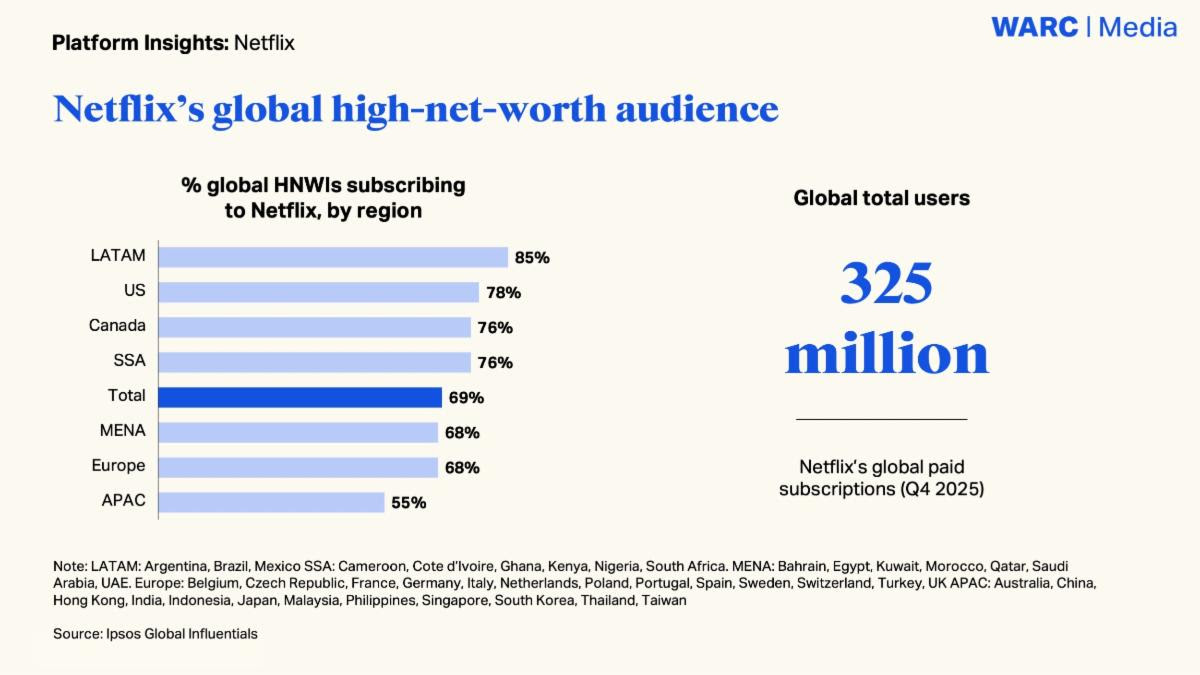

Netflix reports its global audience reach is edging close to 1bn, with members consuming 200bn hours annually. In Q4 2025 its global paid subscription reached 315m. In the UK, Netflix accounted for over half of Subscription Video on Demand (SVOD) viewing last year, with similar dominance in the US.

Netflix’s consumption trends reflect broader shifts and challenges in SVOD, including declining per-user viewing time and competition from free services like YouTube, a trend especially amongst younger consumers. To combat this, it aims to distinguish itself through ‘premium storytelling’.

Algorithmic personalisation

Netflix has successfully captured high-net-worth individuals (

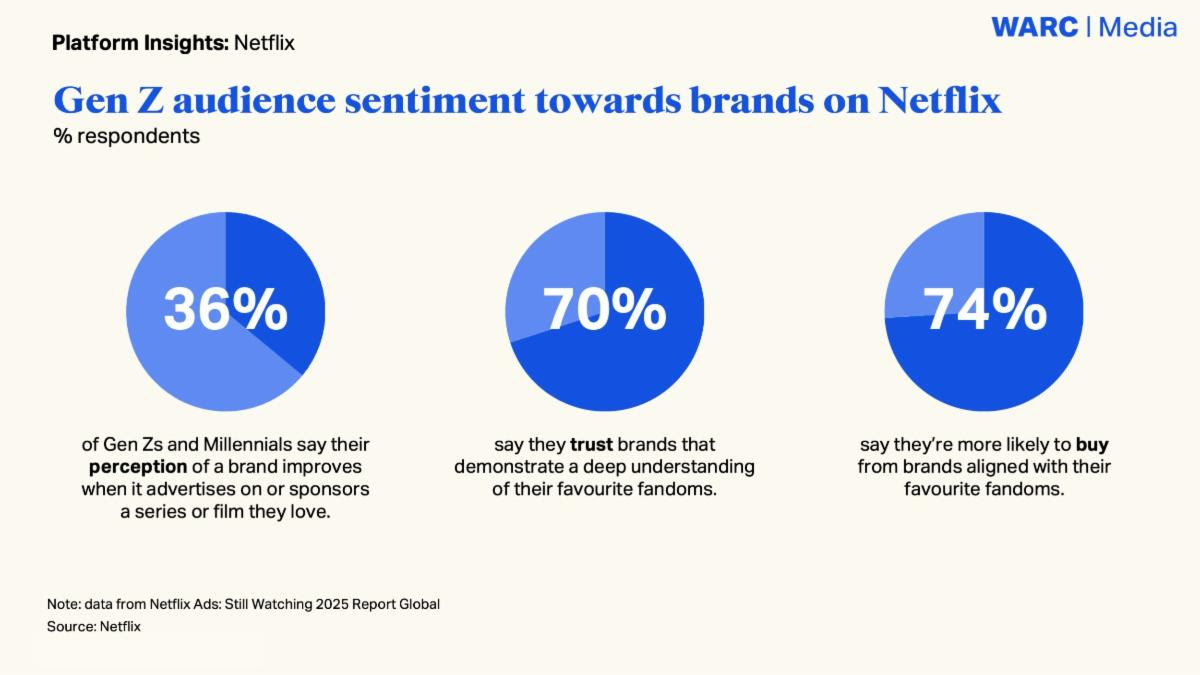

Performance: Brands view Netflix as a ‘trustworthy’ viewing environment and 70% of Gen Z audiences trust brands that connect with their favourite fandoms

Global consumers view Netflix ads as fun, entertaining, and of higher quality through personalised experiences with dynamic ad formats. Advertisers cite Netflix as a high-quality viewing environment and rank it fourth best-perceived “

Gen Zs favour brand integrations with Netflix IP and are 70% more likely to trust brands that demonstrate a deep understanding of their favourite fandom shows