FRANCE (PARIS) — Apr. 24, 2025 — COMvergence’s latest Global Marcom Agency Acquisitions Benchmarking Study 2024, provides a comprehensive analysis of the strategic acquisitions that have reshaped the media and marketing landscape between 2016 and 2024. The report focuses on the industry’s key players, including:

The analysis tracks (Digital, Data, Creative, and Media) acquisitions from January 1, 2016, to December 31, 2024, excluding minority stakes (less than 50%).

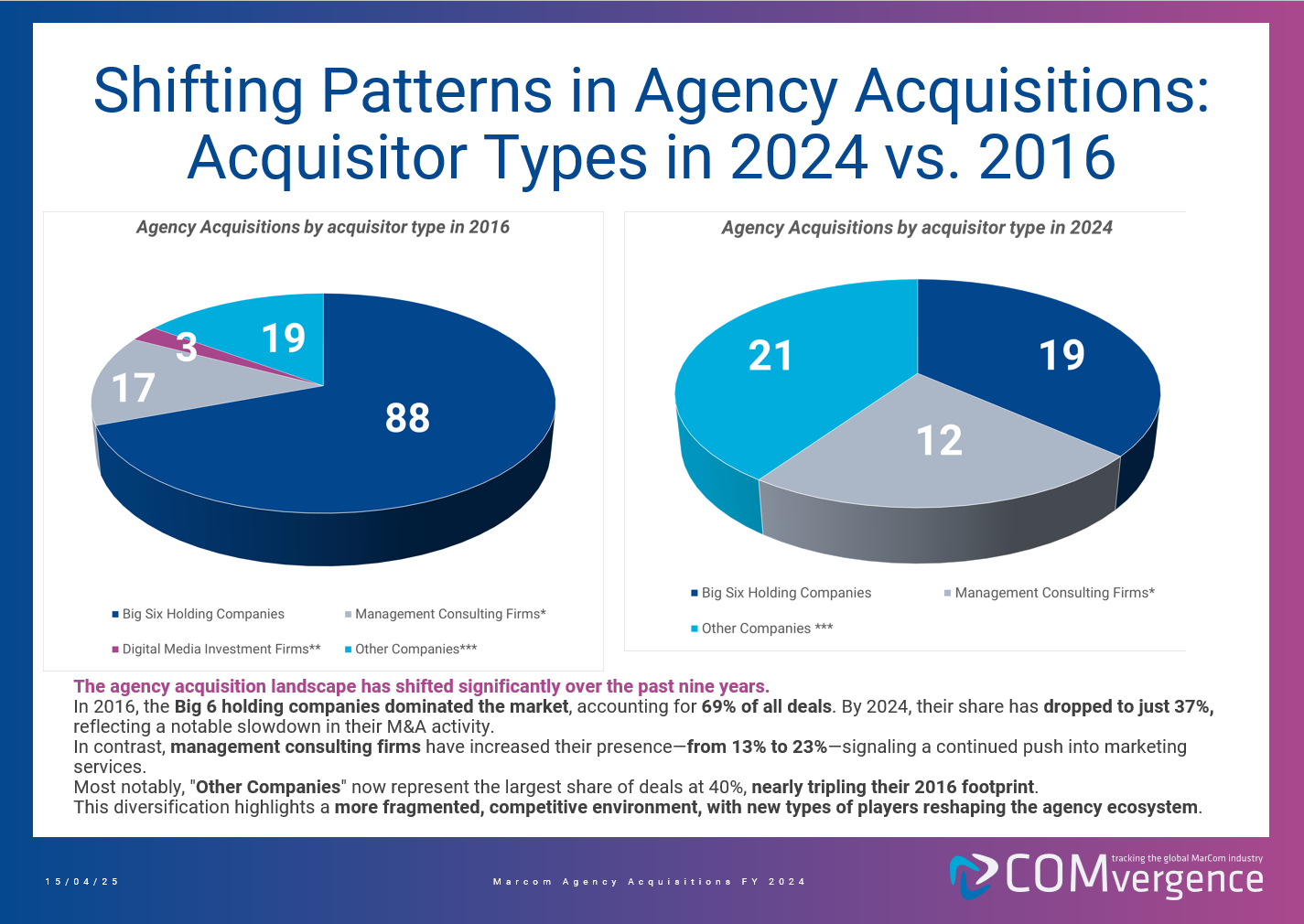

Our latest Marcom Agency Acquisitions Benchmarking Study 2024 confirms the slowdown anticipated in 2023—marking a clear contrast to the post-COVID rebound that began in 2021 and continued in 2022. With just 52 acquisitions recorded, 2024 aligns with 2019 activity levels and remains well below the peak years of 2016 (127 acquisitions) and 2017 (110 acquisitions).

Key Highlights from the 2024 Agency Acquisitions:

Regional & Country Insights:

Since 2016, North America has remained the dominant region for acquisitions, contributing nearly 59% of global revenue and employing the largest share of talent. EMEA continues to drive the highest volume of acquisitions, focusing on smaller-scale deals, while APAC shows strong potential for future monetization.

The U.S. has led global acquisition activity, accounting for 25% of all deals and over half of total revenue, reinforcing its role as a hub for talent and revenue. Other key markets include the UK, Germany, France, and Australia, while India and Brazil remain key for scalable talent, and China and Japan continue to lead for high-value, strategic acquisitions.

E-commerce Focus:

E-commerce acquisitions have accelerated since 2021, with 2022 and 2023 seeing record-high talent additions, surpassing pre-2021 levels. Ascential remained active in 2021–2022, making seven deals and adding 950 employees. Publicis Groupe and WPP significantly scaled their e-commerce focus in 2023–2024, with Publicis adding over 1,000 employees, including through its acquisition of Mars United Commerce, and WPP contributing 870 employees across three deals. Omnicom made a major move in 2023 with Flywheel Digital (2,570 employees), while Accenture reasserted its presence with five deals totaling 940 employees, reflecting a continued consultancy-driven push into e-commerce.

The sustained high volume of acquisitions underscores the industry-wide recognition that e-commerce is a core driver of growth and competitive advantage.

Consultancy-led Acquisitions:

Since 2016, management consultancies have acquired 191 agencies, nearly a quarter (24%) of all M&A activity. This highlights their strategic pivot toward Digital, Data, Creative, and Media capabilities.

Accenture has been at the forefront of this transformation, responsible for half of all consultancy-led acquisitions, with a clear focus on scaling cloud consulting, data analytics, e-commerce, and creative services to establish itself as a leader in integrated marketing solutions.

Deloitte follows with 20% of consultancy acquisitions, while PwC, Capgemini, and McKinsey have adopted more selective, targeted approaches.

This study reveals the ongoing shift in the marcom industry as leading firms continue to build digital, data, and e-commerce capabilities to drive growth, expand global reach, and maintain a competitive edge in the evolving marketing landscape.

India Focus:

Since 2016, India’s marketing and consulting M&A landscape has been marked by a clear shift toward digital transformation, data analytics, and cloud consulting, driven by global networks and consultancies aiming to scale both locally and globally. Dentsu has led this trend, with seven acquisitions totaling over 3,600 employees, including major deals like Ugam Solutions (1,840 staff, 2019) and Extentia (750 staff, 2022), highlighting its strategy to build a full-spectrum, tech-enabled service offering. Havas, with six acquisitions and over 1,100 employees, has focused on creative and full-service digital capabilities, acquiring agencies such as Pivotroots (250 staff, 2023) and Shobiz (330 staff, 2019).

While players like Accenture, WPP, Omnicom, and Hakuhodo have been more selective, their acquisitions—like Imaginea (Accenture, 1,350 staff, 2021), Areteans (Omnicom, 600 staff, 2021), and Kinnect (IPG, 450 staff, 2023)—tend to be larger and strategically aligned with digital innovation and customer experience. Most acquisitions are domestically focused and involve agencies with fewer than 200 employees, often specializing in performance marketing, UX, PR, and content creation. However, some deals, such as those involving Langoor (Havas, 170 staff, 2019) or Imaginea or Areteans, reflect ambitions to establish global delivery capabilities.

Overall, the trend underscores India’s growing importance as both a key innovation market and a scalable delivery hub for global players investing in digital-first, data-driven growth strategies.

Read more: MiQ Elevates Varun Mohan To Chief Commercial Officer In India