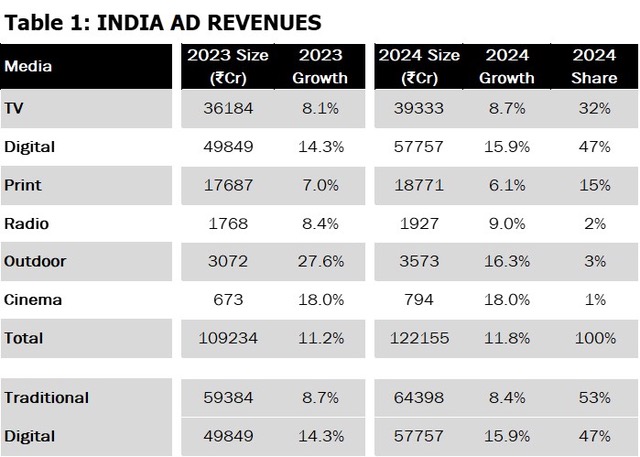

According to IPG Mediabrands’ Magna Global Advertising Forecast 2024, the Indian advertising market is expected to grow at an 11.8% annual rate to reach INR 1,22,155 crore in 2024, up from 11.2% in 2023. This makes it one of the most dynamic ad markets. After expanding by 9.5% in 2023, the APAC ad market is expected to grow by 8.5% in 2024, reaching $266 billion.

Pharma, education, real estate, media and entertainment, building materials, CPG, auto, retail, government, and political advertising, and finance make up the top ten sectors that will be most influential in driving India’s AdEx growth in 2024. According to the Magna Global Ad Forecast report, the Indian advertising market is expected to expand by 10% by 2025. The IMF projects that growth in India will continue to be robust, at 6.8 percent in 2024 and 6.5 percent in 2025. This robustness is expected to be a result of the rising working-age population and sustained strength in domestic demand. These are expected to be the main sectors driving India’s adex growth in 2024.

The APAC region is predicted to grow by +8.5% in 2024, with digital pure-player publishers expected to grow by +11.1% to reach $220 billion (76% of budgets) and traditional media owners expected to grow by +0.8% to reach $68 billion (24% of budgets). TV spending is expected to rise by +0.2% and is expected to level off. The positive impact of athletic events, particularly the Olympics in Paris, is the primary driver of the growth surge.

India is predicted to continue its consistent economic growth and is becoming one of the world’s most dynamic consumer environments. The forecast for consumer spending is still favorable despite the multiplication of per capita income. It is predicted that the economy with the fastest growth will overtake China’s growth rate by more than 2%. India’s economy is predicted to overtake Japan’s and Germany’s by 2028, ranking third overall. In 2025, it is anticipated that India will rank among the top 10 markets. Furthermore, inflation is predicted to drop from +5.4% in 2023 to +4.2% in 2024, and since long-term inflation estimates are still stable, the central bank’s monetary policy is anticipated to support growth.

Digital formats and new media will account for 60% of AdEx growth; digital is expected to grow at a rate of 15.9%, while linear growth will be at an 8.4% rate. By 2026, digital is predicted to account for 50% of total revenues, up from its current 47%. All digital formats, particularly social media, online gaming, and streaming audio and video, are predicted to grow rapidly as long as consumption trends favor digital media. Although it is predicted to increase by 6.1% to INR 188 billion ($2.2 billion) in 2024, ad sales revenue is still 11% less than pre-COVID levels. It is projected that digital print revenue will reach INR 13 billion ($159 million).

Read More: APAC ad market to grow 8.5% to US$289b this year; traditional media owners to see growth

Radio has only recovered 86% of its 2019 levels, still suffering from the COVID slowdown. The medium still faces challenges measuring its audience, but revenue is expected to reach INR 19 billion ($231 million) in 2024, up 9% from the previous year. The circulation of print media decreased from 391 million copies in 2022–2023 to 402 million copies. The revenue from advertising sales is expected to increase by 6.1% in 2024 to INR 188 billion (about USD 2.2 billion), which is still 11% less than pre-COVID levels. In-cinema advertising, which suffered the most from COVID-19, only made a 72% recovery.

However, by 2023, listed companies’ average income and profits had increased by double digits. This is positive because it will result in more private funding going toward marketing and capacity-building initiatives. Budgets for marketing and advertising are predicted to increase in 2024 as a result of the auto industry’s notable growth in all segments in 2023. As more people begin to climb the economic ladder and the general public gains access to the advantages of economic progress, CPG continues to rise.

The largest contributor is the urban sector, but in recent years, rural India has seen growth at a faster rate. Rural demand will increase as normal monsoons are predicted, which is encouraging for the industry. All pop strata are witnessing exponential growth in the retail sector. Among the forces propelling organized retail is a sizable middle class, shifting demographics, rising disposable income, and urbanization. E-commerce has revolutionized business operations and made it possible for new market segments like D2C. Sectoral growth will be aided by quick expansion into Tier-2 and Tier-3 cities.

Read More: GroupM TNTY 2024 Global Midyear Forecast: Global Advertising Revenue would grow to $989.8B in 2024

Digital media continues to be favored by consumption trends. The development of digital public goods has been made possible by the government’s liberal and reformist policies. Particularly social media, streaming audio and video, and online gaming, all digital formats are expanding at a robust rate. Ad-supported video-on-demand platforms have revolutionized viewership by making live sporting events easily and reasonably accessible, contributing to the democratization of content consumption.

As of 2023

In 2024

The print media has reaffirmed its position as the most reliable information source.

In 2024,

Read More: Adjust’s Ignite Drives Mobile Marketing Industry Innovation in India

Radio has only recovered 86% of its 2019 levels, still suffering from the COVID-19 slowdown. Ad rates have not increased despite a massive increase in volume. Hiring the medium is a long-standing problem with audience measurement capabilities. Growth will be aided by higher government ad rates because this year is an election year. The industry will benefit greatly from government recommendations regarding news broadcasts, license fee reductions, and the requirement for mobile devices to have an FM tuner.

Estimated revenue for 2024 is INR 19 billion (US$ 231 million), which represents a +9.0% increase over the previous year.

OOH media is predicted to surpass 2019 levels this year and continue on its current growth trajectory. Traditional, transit, and DOOH are the three forms that are displaying increased revenue. The government’s push for urbanization and infrastructure will increase OOH inventory, particularly premium formats.

In 2024,

It is likely that Roadstar, a unified audience measurement tool created by the national organization of Outdoor Media for the OOH industry, will be implemented. This ought to support growth and serve to illustrate the medium’s efficacy.

Venkatesh S, SVP, director – Intelligence Practice, MAGNA India, said,

“The Indian advertising market is set to expand by 11.8% in 2024, reaching ₹1.2 trillion, driven by a robust 15.9% growth in digital media. Traditional media formats are also growing, enduring the relevance of Print, OOH and Radio in addition to Television. The government’s emphasis on digital public infrastructure is propelling digital ad spend to nearly half of total revenues by 2026. Our forecast highlights social media’s significant rise, overtaking search as the second largest media format after television.”

Hema Malik, Chief Investment Officer, IPG Mediabrands India, commented,

“India’s advertising industry is gearing up for an impressive 2024, with significant growth driven by pivotal events like the general elections and ICC T20 World Cup. We expect substantial ad spend increases across sectors such as auto, retail, and CPG. The anticipated 11.8% growth in ad revenues highlights the market’s resilience and potential. With rural demand expected to rise due to favourable monsoons and digital ad spend projected to reach ₹580 billion, the convergence of traditional and digital media presents unique opportunities for advertisers.”